Managing business finances effectively is crucial for the success of any enterprise, and efficient bookkeeping plays a significant role in this process. For businesses in Brisbane, staying on top of financial management can be a hard task, especially with the unique economic landscape of the city. This article provides top tips for efficient bookkeeping in Brisbane to help you streamline your financial processes and ensure your business runs smoothly.

Understanding the Importance of Bookkeeping

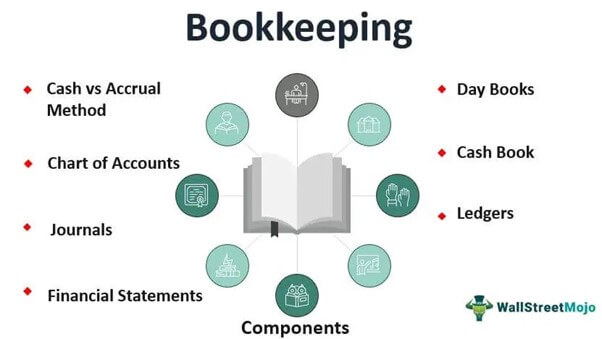

Efficient bookkeeping is more than just keeping track of receipts and expenses; it’s about maintaining a clear and accurate record of all financial transactions to make informed business decisions. Proper bookkeeping provides a foundation for:

- Financial stability: By keeping an accurate record of all transactions, you can monitor your cash flow, manage debts, and ensure you have enough capital to sustain your operations.

- Regulatory compliance: In Brisbane, businesses must comply with various tax regulations and financial reporting standards. Accurate bookkeeping ensures that you meet these legal requirements.

- Business growth: With a clear understanding of your financial position, you can make strategic decisions that drive growth and profitability.

Tips for Efficient Bookkeeping

1. Use Accounting Software

Gone are the days of manual ledgers and spreadsheets. Today, accounting software can automate many aspects of bookkeeping, making the process faster and more accurate. Some popular options include:

- Xero: Particularly popular in Australia, Xero offers features tailored to small businesses, including invoicing, payroll, and bank reconciliation.

- MYOB: Another local favorite, MYOB provides comprehensive solutions for accounting, payroll, and tax compliance.

- QuickBooks: Known for its user-friendly interface, QuickBooks offers a range of features suitable for businesses of all sizes.

Implementing accounting software can save you time, reduce errors, and provide real-time insights into your financial health.

2. Keep Personal and Business Finances Separate

One common mistake that small business owners make is mixing personal and business finances. This can lead to confusion, inaccurate records, and potential legal issues. To avoid this:

- Open a separate business bank account: This makes it easier to track business expenses and income.

- Use a dedicated business credit card: This helps in managing business-related purchases and building a credit history for your business.

- Maintain clear records: Ensure all transactions are documented and categorized appropriately.

3. Regularly Reconcile Bank Statements

Bank reconciliation is the process of matching your financial records with your bank statements to ensure consistency and accuracy. Regular reconciliation helps in identifying discrepancies, detecting fraud, and maintaining accurate financial records. Aim to reconcile your bank statements at least once a month.

4. Stay on Top of Invoicing

Efficient invoicing is crucial for maintaining a healthy cash flow. Here are some tips to manage your invoices effectively:

- Issue invoices promptly: Send invoices as soon as the work is completed or the product is delivered.

- Set clear payment terms: Clearly state the payment due date and any penalties for late payments.

- Follow up on overdue invoices: Implement a system to remind clients of overdue payments and take necessary actions to recover outstanding amounts.

5. Hire a Professional Bookkeeper

While many small business owners handle bookkeeping themselves, hiring a professional bookkeeper can provide significant advantages:

- Expertise: Professional bookkeepers have the knowledge and experience to manage your finances accurately and efficiently.

- Time savings: Outsourcing bookkeeping allows you to focus on core business activities.

- Compliance: A professional bookkeeper can ensure that your financial records comply with local regulations and tax laws.

6. Implement a Filing System

An organized filing system is essential for efficient bookkeeping. Whether you prefer digital or physical records, ensure that all documents are systematically stored and easily accessible. Key documents to file include:

- Receipts and invoices: Keep copies of all receipts and invoices to support your financial records.

- Bank statements: Store all bank statements and reconciliation reports.

- Tax documents: Maintain records of all tax returns, payments, and correspondence with tax authorities.

7. Monitor Cash Flow

Cash flow management is critical for the survival and growth of any business. Regularly monitor your cash flow to ensure that you have enough liquidity to meet your obligations. Some strategies to improve cash flow include:

- Negotiating better payment terms: Work with suppliers to extend payment terms and with clients to shorten payment cycles.

- Reducing unnecessary expenses: Identify and eliminate non-essential costs to improve your cash flow position.

- Building a cash reserve: Maintain a reserve of funds to cover unexpected expenses or periods of low revenue.

8. Stay Informed About Tax Obligations

In Brisbane, businesses must comply with various tax obligations, including GST, payroll tax, and income tax. Staying informed about your tax obligations and deadlines can help you avoid penalties and ensure compliance. Consider the following:

- Engage a tax advisor: A tax advisor can provide guidance on tax planning and compliance.

- Use accounting software: Many accounting software solutions include features to help you manage tax obligations.

- Stay updated: Regularly check for updates to tax laws and regulations that may affect your business.

9. Conduct Regular Financial Reviews

Regular financial reviews are essential for understanding your business’s financial health and making informed decisions. Schedule periodic reviews to analyze your financial statements, identify trends, and assess your performance against your goals. These reviews can help you:

- Identify areas for improvement: Spot inefficiencies or areas where you can cut costs.

- Plan for the future: Use financial insights to develop strategies for growth and expansion.

- Ensure accuracy: Verify that your financial records are accurate and up-to-date.

Conclusion

Efficient bookkeeping is the backbone of successful business financial management. By implementing these tips, businesses in Brisbane can streamline their bookkeeping processes, ensure regulatory compliance, and make informed decisions that drive growth and profitability. Whether you choose to manage bookkeeping in-house or hire a professional, the key is to stay organized, use the right tools, and regularly review your financial position.